French investors spout off about new law, pitting reformers against nationalists

With a 12-year history teaching in France and love of the language, I’ve come to admire France’s true pride in its culture. Many a book, article and web site love to lambaste such antics, often punctuating their remarks by noting how unwelcome non-French speakers are received. This might have been true en masse 10-20 years prior, and it certainly never hurts, in any country, to make some communicative linguistic attempts. Nowadays, the French are as welcoming as many of their European counterparts. And please don’t cynically write off recent hospitality in light of the strengthening Dollar and Europe’s lagging economy.

France’s latest bout of nationalism, however, is fully unconnected with its language, cuisine or concerns about la culture française being in decline. This time around, it’s not personal, but just business.

Voted in law in 2014, and set to be enacted in early 2016, the new Florange law is pitting French reformers vs. nationalists at home and worldwide. Unless investors opt out through a 2/3rds majority, shareholders with over two years of ownership will automatically see their voting rights double.

Those in support are doing so to protect France’s long-term interests, reward loyalty, and fend off hostile takeovers by outsiders. From a larger perspective, and according to this Economist article, only a single French firm remains in the global top 50, with l’hexagone’s stock market value having declined by 60% in terms of worldwide share. One article from a private law firm even calls the critics’ concerns “overblown.”

Many are nonetheless staunchly opposed to the legislation. Moving away from the traditional conventions of “one share, one vote” will cause French stocks to be less easily traded worldwide, almost giving them Asian-like idiosyncrasies, not to mention exceptionally lower discounts and valuations. Good coverage here from Bloomberg and this is a great piece from Reuters about the inner workings of an individual company, the French aerospace group Safran.

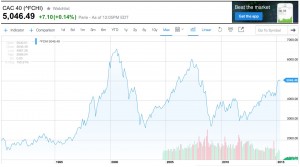

In general, I tend to support commercial enterprises wending their way in a market economy free of extensive governmental influence. While I’ve seen multiple variations up close and personal, and especially in Asia, most economies are more successful over the long term. However, part of what has catapulted France to its position today is the ardent nationalistic support of its government and citizens, not only domestically, but also from throughout the EU. Consider the performance of the CAC-40 stock market (see graphic below). For example, how successful would the acquired assets of a firm perform, post-takeover, with only figurehead aspects of French governance? Yet, conversely, at what cost, as plummeting valuations and substantial discounts won’t excite any investors, regardless of their country of origin.

A collateral question to ponder is the fine line between a nationalist and a reformer. Some perspective from the musical Wicked is refreshingly quite à propos. As quoted from the song Wonderful: “We believe all sorts of things that aren’t true. We call it history. A man’s called a traitor, or liberator. A rich man’s a thief or philanthropist. Is one a crusader or ruthless invader? It’s all in which label is able to persist.”